2017 Dialogue #7: All About the Allowed Rent Increase

In this final summer 2017 facilitated dialogue, landlords and tenants found little to agree on. The agenda centered on several issues from the previous session’s agenda: the annual rent increase, relocation fees, no-just-cause tenancy terminations, and exemptions from rent stabilization for 4-unit and smaller properties. In this #7 facilitated dialogue it was clear City Council would be resolving the tough issues.

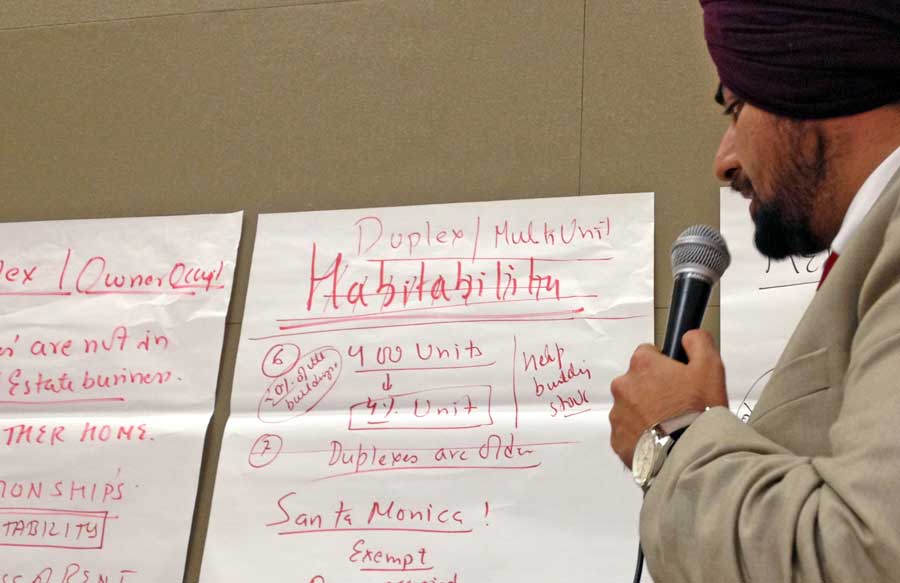

Facilitator Sukhsimranjit Singh opened this last and evidently final dialogue #7 with an easy ask: the proposed tenant-landlord committee. In fact both sides already have agreed on it. Tenants proposed it originally and landlords could see the value. Our rent control city neighbors already have one, and Beverly Hills many years ago had one too.

However there was some difference in how each side view the role of the committee. Landlords see it as a means to resolve disputes, like Culver City. That city’s committee was suggested as a model. However that committee has little real power; its meetings are not even archived or viewable online.

Tenants in contrast see a policy role for the committee.That would follow the lead of cities like Santa Monica (an elected commission with far-reaching powers) and West Hollywood (appointed with a policy role in housing generally). Landlords were cool on a committee with a policy role.

Landlords did suggest a task for the committee though: “Over the next 30, 60, 90 days it would examine the data and evidence that led to the urgency ordinance: the regulations were ineffective, that rents were escalating and tenants were displaced – lets find that data.” One landlord cut to the real issue: “We challenge the premise of enactment of the rent stabilization program.”

Tenant committee member Chuck Moffitt (pictured above) replied that our side was looking forward, not backward, as the rent stabilization ordinance is already in place and a Rent Stabilization Program is in the process of formation.

Next Singh teed up the rent increase. “Tenants speak first.” Chuck Moffit stated the key point: “Public policy should be based on evidence – it should be data driven. So we reference that [in our rent cap] by using the Consumer Price Index (CPI) because it is the basis for almost every other rent-stabilized city’s increases.”

Chuck then cited the following cities as examples that hew close to CPI (or below) for allowed increases:

- Berkeley: .65% of CPI (less than one percent)

- West Hollywood .75% (less than one percent)

- Santa Monica: .75%

- Los Angeles: flat 3%.

Chuck said that using CPI was the only objective means of establishing an allowed rent increase. The Bureau of Labor Statistics publishes an index of consumer prices for urban consumers commonly referred to as CPI which includes a wide variety of consumer prices.

Chuck continued. “Second, we’ve heard assertions about the [high] cost of doing business here, yet we’ve yet to see any paper [showing it],” Chuck said. “We have addressed your position [by offering something above CPI] but you’re saying, ‘We can still go to City Council and win.’”

“Third, we make any allowed rent increase contingent on the landlord’s keeping the apartment up to a habitability standard,” he said. “Our greatest concern is that the unit not fall below standards,” Chuck said. “Ten years – that’s 120 monthly rent payments – what if the drapes are old and the landlord says ‘no’ to replacement? Or the fridge is old but the landlord says, ‘It works…’ For the allowable increase we want the landlord to perform to a standard.”

But it did not sit well with landlords. “We can talk forever about CPI,” one landlord said. “CPI is not an appropriate measure.” He continued, “We’re trying to balance habitability, tenant retention and affordability. We’re going to ask City Council to work with staff to get a professional economist to analyze the actual data and the issues.” He added, “If the city has $2 million for a rent stabilization program, then they can hire an accountant.”

The landlords were also concerned at the prospect that tenants could veto a rent increase. If the increase is NOT automatic but instead is conditioned on tenant approval, a landlord said, “Then the 3% floor is meaningless – the tenant has the ability to challenge that increase.”

Another landlord said she’d tell tenants to furnish their own drapes. “I’ll say, ‘Put up any treatments you want.’” Another who uses quality materials added: “I put in expensive linoleum but [the tenant] will say it’s the same as off-the-shelf [cheap stuff]. But it lasts longer.”

Singh saw the discussion heating up. “The tenants committee came out with a positional statement and now the landlords counted with a positional statement. Let’s bring the tone down.” Singh introduces a break and asks landlords to consider our ‘CPI-married’ proposal.

Rent Increase Continued

After the break the landlords returned to the allowable rent increase. “We’re in agreement with the habitability standard – with a 7% [allowed annual increase] we can tie it to habitability,” one landlord said. “We need 7% to improve and maintain the asset.” (That has been the landlords’ position since early spring.)

Tenants pointed out that maintenance was built into the rent; and improvement is an expense that the landlord recoups through a higher rent on vacancy.

Chuck said, “Our position is that a lease renewal or increase is contingent on that property being in the condition it ought to be in.”

“There are bad actors but the majority have met habitability standards,” a landlord said. As for accountability, he pointed to the tenant-landlord board and also suggested the city adopt a “more robust code enforcement system.” He quickly added, “But not a registry.”

Clearly the rent stabilization program as a whole remained the key problem for landlords.

Mayor Lili Bosse had a question for the landlords about tying the increase to performance. “Is CPI your sticking point?”

“The 800 pound gorilla is the registry, period,” said one landlord philosophically opposed to the entire rent stabilization program. “All of us are under pressure, that we have to do something [by January when rents under the registry must be certified by the city]. Let’s work though this [without pressure]. There will never be an absence of [habitability] disputes. There will be administrative headaches in implementing this program.”

Lili asked again, “What is the sticking point?”

He replied, “The tenant-landlord board can resolved habitability disputes. Why tie it to rents? We would fight tying habitability [standards] to an increase that is allowable. Maybe above the allowable [increase]….”

Lili tried once more. “There are two parts: 1) tying the allowable rent increase to the rent index, which is higher than 3% – now it’s 3.9% and capped at 8% [as was discussed in this meeting]; and 2) making the increase contingent on habitability standards as agreed by landlords and tenants. If the habitability issue can go to a board, are you still opposed to number 1?”

She meant accepting that the allowed increase can be derived from the BLS rent index. But the landlord replied flatly, “It is 7%.”

Singh: “Let’s close the gap. I give the power to you. Let’s tackle the fear, that landlords worry it can go to 3% or tenants that it goes back to 10%. We need to move forward.”

Singh then offered his own proposal. “Landlords are at 7%. The CPI is at 3.9%. The business tax is 1.2%. If we add 1.2% to the 3.9% we’re at 5.1%. Let’s discuss it – a simple number you both can agree on.”

Singh then offered his own proposal. “Landlords are at 7%. The CPI is at 3.9%. The business tax is 1.2%. If we add 1.2% to the 3.9% we’re at 5.1%. Let’s discuss it – a simple number you both can agree on.”

Tenant committee member Mark Elliot asked, “Why the 1.2% figure?”

Singh replied, “Landlords say they have higher utility costs, higher maintenance costs, and they say that they can’t take care of their buildings. They will lose the buildings. The 1.2% is a number given to me by the business tax.”

Mark said that it then seemed like tenants would be paying the landlord’s business taxes.

A landlord asked Mayor Bosse, “Assume we agree on a number – what assurance do we have that Council will say they agree? They can say, ‘We’ll amend it.’”

Mayor Bosse said, “I’ve been listening, involved, and whatever comes before us, in my view, has tremendous weight. What comes as a recommendation from you be assured will carry a lot of weight.” (She could offer no guarantee.)

The Mayor has attended all three tenant-landlord table dialogues as did councilmembers Bob Wunderlich and Les Friedman. (Mirisch and Gold so far are no-shows.)

Rent Increase Continued Again

After a break the landlords offered a “package deal.” The ‘package’ used Singh’s 5.1% as a takeoff point for the annual increase. The offer:

- 5.1% “plus water surcharges and city services, like sewage” OR a flat 6% increase (down from 7%);

- Eliminate the registry (“there’s no need – let’s use the money for code enforcement” a landlord said);

- Exempt all duplexes (an estimated 220 properties) and owner-occupied 3- and 4-unit properties (257 additional properties).

Tenant committee representative Alma Ordaz objected to a package that included a provision we could not accept: no registry. “The registry is critical – without that data it’s all a shot in the dark.” Besides, she said, the rent stabilization program would likely be revenue neutral “and may even be revenue-generating” (though increased business licensing, taxes and enforcement fines). Data was the key, she said.

(Read more about what the registry would accomplish and why the landlords claim it can’t work for them.)

If the package includes a pass-through for water surcharges and city services, like sewage, that could push rents higher – much more so than the .9% spread between the 5.1% in the package and the 6% earlier concession from the landlords.

But tenants didn’t have enough information to evaluate the option thoroughly. If a tenant would be obligated under their 5.1% option for “the entirety of the utility bill,” as one landlord said, then putting tenants on the hook for significant costs that are already included in the base rent would be a deal-breaker anyway.

For the landlords, though, the tenants committee’s proposal was equally unworkable. The sticking point: tying the increase to CPI. One landlord said:

You say CPI includes profit. But it would not be fair to everyone because some bought a year ago while some bought 25 years ago. All landlords are not situated equally, so it’s a fallacy to say, ‘We give you CPI and you still profit.’ We simply disagree on CPI – it doesn’t apply to housing, in our opinion.

To keep their current 7% ask, the landlords have frequently mentioned that city’s business tax is higher than other cities. “The business tax IS higher than Los Angeles,” Michael added, “but in our view it is built into your base rents. [Singh] wants to add it on.”

(The business tax runs about $25-$30 monthly for an average apartment.)

Singh responded, “We have gone from 7% to 5.1% plus utilities. landlords say they need the flexibility. We all can come together on this issue.” He then moved on to relocation fees.

Relocation Fees

The tenants committee highlighted how current fees fall short of tenants’ needs when they are told to move their home. Tenants proposed several changes from the current ordinance:

- Relocation fees should be provided to all households regardless of length of tenure;

- Relocation fees should be adjusted according to the same formula or amount as the allowed annual rent increase;

- Relocation fees should be paid into escrow by the landlord at the time he notifies the city of an involuntary termination;

- Temporary relocation fees on a per-diem basis should be established;

- Relocation fees should reflect estimated actual costs the household will incur to relocate.

The tenants did not offer a specific dollar amount for the relocation fee schedule, but did suggest that the award for any protected-classes of tenants be raised from $2,000 to $3,000 with an additional award of 50% ($1,500) for every additional member of any protected tenant class (like a second senior).

“We have to see it on paper,” one landlord said, “but in theory it makes sense. That assumes exemplary residents – not those that are a detriment to the community or who are disturbing tenants’ enjoyment. We don’t want to reward their bad behavior.”

Likewise he revived a suggestion from their side that relocation fees be means-tested. That entails asking tenants to prove their income and assets, evidently.

“A senior with a $10M estate? I don’t believe that relocation fees are necessary.” However he is in agreement with the current fee amounts, he said. (The relocation fees at their current levels was mandated for all tenants by ordinance in February. The fees were reduced from January. Read more about that change.)

Singh next suggested that we address Chapter 5 tenants. He introduced tenant Audrey Linden, who noted that most Chapter 5 tenants are seniors and that the new policies eroded some protections. Specifically she was concerned that relocation fees that once were indexed to length-of-tenancy now are flat fees; and suggested that relocation fees be awarded for mandated, temporary dislocation, like for repairs, etc. (Her concerns were noted but not discussed in detail.)

[Note: for Chapter 5 tenants, involuntary terminations are limited to specific instances: extensive remodeling or taking a property off the rental market, for example. Relocation fees were mandated in those instances but were not adjusted for inflation. New fees that apply for both Chapter 5 and Chapter 6 tenants are increased.]

Singh suggested we move on to discussing tenancy terminations. Specifically, no-just-cause terminations (30- or 60-day notices). Time was running short.

(Where Chapter 5 tenants were protected from no-just-cause eviction, Chapter 6 tenants have always faced the threat of involuntary termination “for any reason or for no reason at all,” according to city policy, which simply defaults to state law on the matter.)

The tenants committee wants to end no-just-cause terminations. “It’s a tool that we must have,” one landlord said. “It’s almost impossible to move [an eviction] though the court process.” Another agreed: “Everything is arguable in court.” The first added, “It’s semantics: ‘No-just-cause.’ There is a cause, but it may not be actionable in a court. Let’s call it ’60-day termination.’ It’s a tool for both tenants and landlords.”

“We see eye-to-eye,” tenant committee member Michael said. “You don’t want to pay the fees, we don’t want to have to take them. For us it’s a concession prize for having our lives upturned. We want it to be a seldom-used tool.”

“Sixty-day terminations are already expensive for us: the relocation fees, the lost rent, the unit repairs,” the first landlord said. “Yes, there are unscrupulous landlords but we could have to report any termination on a form.” (That would ensure that the rent was not then unlawfully raised after the termination, which is a prime disincentive to terminate a tenancy. However, February’s rent stabilization ordinance already mandates that landlords file a notice of eviction with the city shortly after the tenant gets her notice.)

What about landlord retaliation? Tenants expressed great concern about being told to go for making a complaint. “You have many options,” said a landlord. “Hire a private attorney – attorneys want to do it on contingency, like personal injury. You can go to legal aid if you qualify [there were numerous such programs he said]. There are damages. And the City Attorney can prosecute it. You won’t have any problem.”

Singh said, “Ninety-nine of 100 civil cases are settled out of court.” He suggested a fund could be started to help tenants. Or the mediation board could handle it.

Tenant committee member Gwen Owens asked landlords how often they used no-just-cause evictions. “Once in a decade,” one said. “Well then it’s not a real issue,” Gwen replied. “We’re arguing a point that’s [not relevant]. I don’t see a ‘bad tenant’ as a reason to keep involuntary termination.”

On ending no-just-cause our committee agrees. This is from our proposal:

The Committee believes that allowing no-just-cause tenancy terminations creates an atmosphere of fear in the resident base; discourages tenants from reporting unsanitary or substandard unit conditions; and substitutes as an inappropriate, if convenient, alternative to for-cause evictions for landlords.

A landlord countered, “If it’s once in ten years then it appears I have not abused it.” To which Gwen replied, “It’s about being human – having a place to stay without feeling intimidated.”

Tenant committee member Ramin Zar also highlighted the human side, noting mass tenancy terminations in the past with little action from the city. One landlord called it “the nuclear option,” but said it was necessary when a problem tenant causes others tenants to say ‘They go or I go.’

Singh summarized: “Landlords say they don’t use it a lot. Tenants are saying that [keeping the policy] feels like giving up power. I see both sides.”

Singh moved on to categorical exemptions from rent stabilization.

One landlord came out arguing hard:

Every owner of a duplex is not in the real estate business. Owners of duplexes and under-4 units regard their entire building as their personal residence. They form personal relationships with tenants. We have our lives in the building and we bear expenses for the entire building but income only comes from the portion rented out. Visitors comment on the charm of these smaller buildings, but the cost to maintain them – most over 60-70 years old – is greater. That’s significant to justify the exemption.

Other landlords agreed. “I don’t want to see these buildings torn down for high-end condos and rental units,” another said. As for higher costs of maintenance, another said, “The roof costs the same [in a smaller building like a 3-unit] but there are only two tenants to fund it.” A third landlord minimized the magnitude of the exemption by pointing to duplexes alone (even though the proposal is much broader): “They are 20% of buildings and 40% are owner occupied. It affects maybe 3% of total tenants.”

Tenant committee member Chuck Moffit replied, “We’re here to talk about rent stabilization. You’re talking about over 400 duplex units, but no rent-stabilized city exempts all duplexes. As for the ‘mom-and-pops,’ the fact is, you all have ‘customers’ – they are the renters. When owners invest they become businesses: they depreciate [assets], they form LLCs – they are landlords.”

Tenant committee member Michael agreed. “Why are their customers subject to less protections?” The landlord responded, “We’re not saying they should be exempt – just that the past ordinance’s 10% should be in effect.” (But when asked whether such business operators would be obligated to pay relocation fees, for example, a landlord shook his head ‘no.’)

A few members of the public spoke. They owned small apartment buildings and lamented that rent control in Santa Monica keeps their margins thin which then prevents them from maintaining the properties. (“Mine is going downhill,” one said.)

With that exchange punctuating some lack-of-agreement on an exemption, dialogue #7 came to a close just ten minutes past the cutoff time. Singh summarized dialogue #7 by saying:

- “We’re coming close on rent change;

- “We’re mostly in agreement on the registry & habitability standards;

- “We’ve seen movement on relocation fees; but…

- “We have differences over exemptions and no-just-cause terminations.”

“This is not the end, but I do need to bring this to a conclusion.” He remained open to anther session (dialogue #8!), he said, but will give his report to City Council at the September 5th formal (evening) meeting. “Let’s take time to reassess. This is like Newton’s Law: energy invested never goes to waste.”

For more please read my takeaway from dialogue #7.