Allowed Rent Increase for Chapter 6 Rises to 4.1%

Today City of Beverly Hills announced a bump-up in the maximum allowed annual rent increase for Chapter 6 tenants. Effective June 12th the cap is 4.1% up from 3%. While that may come as a surprise, the Municipal Code allows the maximum rent increase to rise with inflation — specifically the percentage change in the Consumer Price Index for our region. As calculated by the Bureau of Labor Statistics consumer prices have risen 4.1% and so has our rent.

Tenants who receive the Renters Alliance email newsletter know that the current 3% cap on the maximum allowed annual rent increase for Chapter 6 tenancies was neither permanent or fixed at 3%. As adopted by City Council in January of 2017, the cap was 3% but the following month City Council made a subtle but important tweak: the allowed rent increase until further notice would be the greater of 3% or the annual percentage change in consumer prices (CPI). The 3% went from being a cap on the increase to being an effective floor. If consumer prices increased by a greater percentage, then so would rents.

The bump-up is baked into the Municipal Code as the city explains in a press release:

On June 12, 2018, the Bureau of Labor Statistics published the local CPI for May 1, 2018, which showed an increase of 4.1% over the local CPI for May 1, 2017. Therefore, the maximum annual allowable rent increase for a rental unit subject to Chapter 6 of the Rent Stabilization Ordinance that is imposed after June 12, 2018, is 4.1% (See B.H.M.C. § 4–6–3).

Turning to Municipal Code Chapter 6 section 3 we see the provision (with my emphasis):

Only one increase shall be permissible within any twelve (12) month period…Such increases [sic] shall not exceed the greater of: 1) three percent (3%) of the rental rate then in effect, or 2) the percentage equal to the percentage increase, if any, of the consumer price index for the Los Angeles/Riverside/Orange County area, as published by the United States department of labor, bureau of labor statistics between May 1 of the then current year and May 1 of the immediately preceding year. — Municipal Code 4–6–3 ‘RENTAL INCREASES’

The Bureau of Labor Statistics (properly capitalized!) calculated a 4.1% increase in consumer prices for the year ending this past May. So in June the allowed rent increase matched that figure. Some tenants will be increased by the maximum allowed; others may not be.

What is CPI? It is a measure in the change in costs for products and services purchased by urban consumers in our Los Angeles-Long Beach-Anaheim region. And 4.1% in fact represents the largest annual jump in many years.

As for Chapter 5 tenants, they are seeing the biggest change in the maximum allowable annual rent increase by far this year. Scroll down for more about that.

How a Tweak in the Original Ordinance Made it Happen

Let’s go back to January of 2017 when City Council adopted an urgency ordinance. Council reduced the allowed rent increase to 3% from 10%. In that ordinance there was no provision to tie the increase to the change in consumer prices. It was a flat 3%. Here is what the original urgency ordinance said:

Paragraph B of Section 4–6–3 (“Rental Increase”) of the Beverly Hills Municipal Code is hereby amended to read as follows: Such increases shall not exceed a maximum amount of three percent (3%) of the rental then in effect.

Tenants will remember the elation: not only was the annual increase capped at 3% at that meeting but relocation fees took effect too. Then the fee topped out at $21,650 for a 2-BR unit. But the good feeling didn’t last long: the next month City Council slashed the top relocation fee to $14,394 and allowed the rent increase cap to float as high as inflation may take it. The amended language:

The City Council hereby amends Paragraph B of Section 4–6–3 (‘Rental Increase”) of Chapter 6 of Title 4 of the Beverly Hills Municipal Code to read as follows: Such increases shall not exceed the greater of: (1) three percent (3%) of the rental rate then in effect, or (2) the percentage equal to the percentage increase, if any, of the consumer price index….

That language remains in the ordinance today. Back then we called it a half-loaf of tenant protections and we argued against making the change (to no avail). The new ordinance language was adopted with virtually no discussion.

Consumer Prices Are Likely to Continue to Rise

Consumer prices are rising and they are forecast to continue to rise. Growth was on the increase and the Republican tax law further stoked what the economists called a late-cycle economy that might otherwise moderate. The additional borrow-now-pay-later stimulus means that inflation should march upward.

Indeed the trend is clear according to the Bureau of Labor Statistics press release. The annual increase in consumer prices has climbed from an average of 2% for our region to 4.1% in May.

City officials knew an increase in the percentage was coming. But the magnitude (4.1%) of the increase took all of us by surprise. A couple of months ago, the city increased taxes and fees by 3.6% – the rate of change then for consumer prices in our region. When the monthly year-over-year figure for May was announced it was higher: 4.1%.

CPI Adjustments: Harm or Benefit?

Tenants who chafe at the new 4.1% cap could feel that indexing the rent allowance to the change in consumer prices was a bad idea. However tenants have argued for CPI rather than fixed-percentage cap. Most rent-stabilized cities use CPI as a benchmark.

Landlords, however, object to tying the allowed rent increase to CPI because, they say, CPI doesn’t properly represent the change in their costs. However given the increment upward in the allowed rent increase to 4.1% today, we are actually getting close to the 5% ‘compromise’ number that the dialogues facilitator pressed hard for last summer.

Does the current 4.1% CPI-linked increase sound like a workable compromise? Contact me with your view.

What About Chapter 5 Tenants?

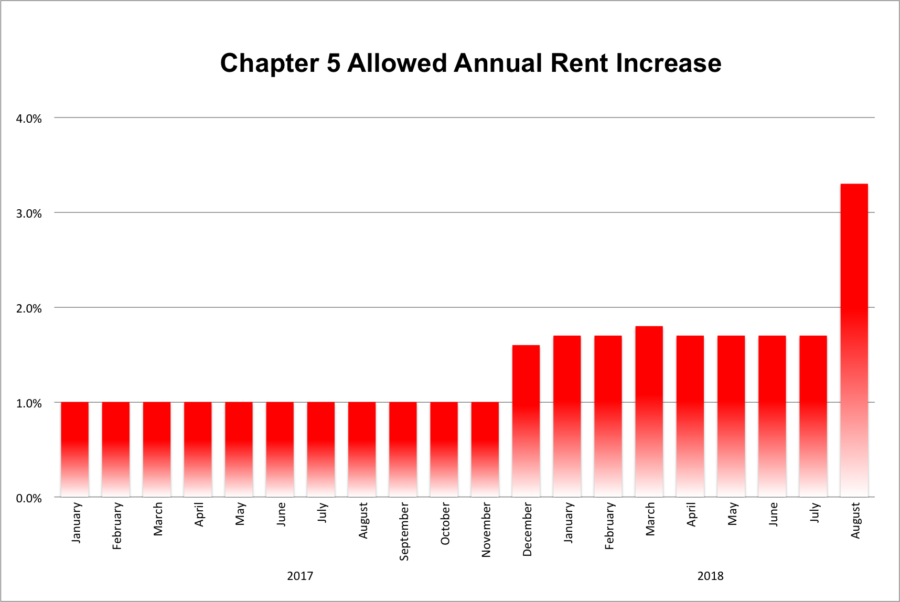

Left out of this discussion so far are the 3% of renting households that fall under the city’s earlier Chapter 5 rent stabilization ordinance. Those lucky folks got a much sweeter deal than the rest of us. Because of low inflation their rent has long increased by only 1% on average each year and it even dipped below that in some months. More recently it was a pretty steady 1.7% on the rent increase.

Until recently. Here is the latest city-generated Chapter 5 increase which, like the past increases, was posted on the city website. It’s quite a jump.

What would account for that jump? When we plugged in CPI data into the city’s complex Chapter 5 formula we could not reproduce the city’s posted figures. Try it at home: find the CPI figures here for the LA-Long Beach-Anaheim region and then plug them into a spreadsheet using this formula:

The proper method for computing such an increase in the CPI shall be as follows: The latest published CPI figure shall be added along with such figures for the preceding eleven (11) individual months, and, from the sum reached, there shall be deducted the sum of such figures for the twelve (12) months further preceding the last such twelve (12) months. That remainder shall then be divided by the lower of the two (2) sums heretofore mentioned, and the resulting figure shall indicate the permissible maximum percentage by which the base rent may be increased by virtue of the rise in the CPI. -- Municipal Code § 4-5-3

Easy, right?